BTC Price Prediction: Is Now the Time to Invest?

#BTC

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge

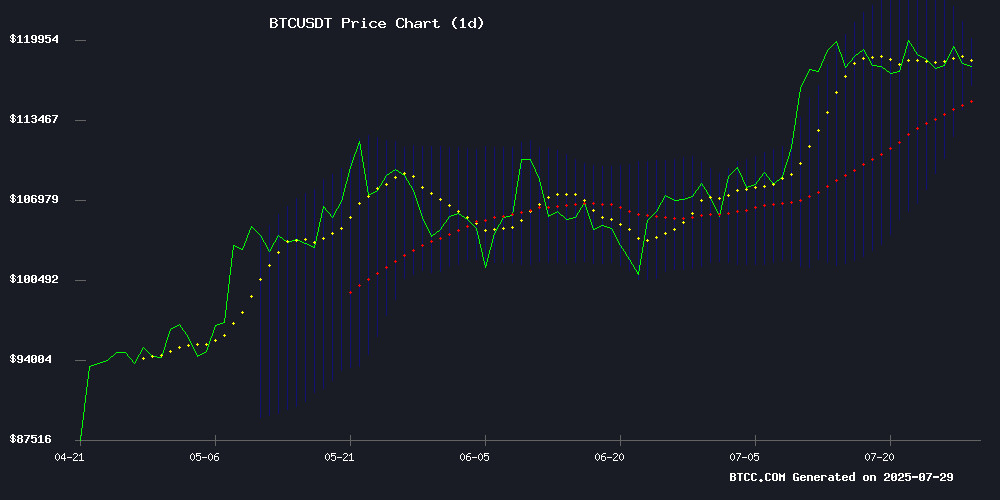

According to BTCC financial analyst Emma, Bitcoin (BTC) is currently trading at 118,350.02 USDT, slightly above its 20-day moving average (MA) of 118,213.77. The MACD indicator shows a bullish crossover with the histogram at 2001.6542, suggesting potential upward momentum. Bollinger Bands indicate a stable range, with the price hovering near the middle band. Emma notes that a sustained break above the 20-day MA could signal further gains, targeting the upper Bollinger Band at 120,098.83.

Market Sentiment: Institutional Confidence and Macro Factors Support BTC

BTCC financial analyst Emma highlights strong institutional interest in Bitcoin, with Metaplanet expanding its BTC treasury to $2 billion and Strategy Now holding $71 billion in Bitcoin. Positive analyst predictions, including targets of $170K-$350K, further bolster sentiment. However, regulatory uncertainty, such as the delayed CFTC nomination, and U.S. crypto adoption challenges pose risks. Emma believes the overall sentiment remains bullish, driven by institutional accumulation and easing macro tensions.

Factors Influencing BTC’s Price

Analyst Predicts Extended Bitcoin Rally, Suggests $170K-$350K Targets

Bitcoin's surge to a record $123,217 on July 14 has ignited debate about its future trajectory. Market observers like Bitwise CIO Matt Hougan and anonymous analyst @TechDev_52 argue the cryptocurrency may be decoupling from its historical four-year halving cycle, instead tracking broader macroeconomic trends.

Institutional adoption and ETF inflows are reshaping Bitcoin's market behavior, with some experts now viewing it as a macro asset rather than a cyclical play. @TechDev_52's analysis suggests potential targets between $170,000 and $350,000 by 2026 if current patterns hold.

The article highlights Bitcoin Hyper as a speculative altcoin play for investors seeking leveraged exposure to crypto's next growth phase. This comes as traditional technical patterns give way to new valuation frameworks influenced by institutional participation.

Metaplanet Expands Bitcoin Treasury to $2 Billion, Stock Surges

Tokyo-listed Metaplanet has acquired an additional 780 Bitcoin for $92.5 million, bringing its total holdings to 17,132 BTC worth approximately $2 billion. The company's shares jumped 5.6% following the announcement, extending its year-to-date gain to 258%.

Metaplanet's aggressive Bitcoin strategy has transformed it from a struggling hotel operator into Asia's largest corporate Bitcoin holder. The firm now ranks seventh globally among public companies by BTC holdings, trailing only US-based giants like MicroStrategy.

CEO Simon Gerovich revealed the company's average purchase price of $101,030 per Bitcoin, generating substantial unrealized gains with BTC currently trading near $119,300. The treasury's 449.7% yield for 2025 demonstrates the success of its April 2024 pivot to digital assets.

Quintenz's CFTC Nomination Delayed Again Amid Crypto Regulatory Uncertainty

Brian Quintenz's path to leading the Commodity Futures Trading Commission (CFTC) faces another setback as the Senate Agriculture Committee postpones its vote on his nomination for the second time. The delay leaves the U.S. commodities regulator in limbo as it prepares to potentially oversee Bitcoin (BTC) and broader crypto markets under pending legislation.

The committee abruptly removed Quintenz's nomination from its Monday agenda without explanation, following an earlier postponement last week. With the Senate's August recess approaching, the confirmation process may stall for weeks, exacerbating leadership uncertainty at the CFTC.

Acting Chair Caroline Pham, a Republican appointee, currently steers the agency but plans to depart once a permanent successor is confirmed. The leadership vacuum emerges as Congress considers expanding the CFTC's authority over cryptocurrency trading - a move that could redefine U.S. digital asset oversight.

Bitcoin Holds Steady Amid US-China Trade Talks, Altcoins Show Promise

Bitcoin remains remarkably stable as the US and China negotiate an extension of their 90-day tariff truce, a move aimed at preventing further disruptions to global trade. The cryptocurrency, currently priced at $118,000, is poised for another potential breakout. This stability isn't isolated to Bitcoin alone—several altcoins are also demonstrating significant upside potential, driven by more than just market greed.

Geopolitical tensions have reignited interest in cryptocurrencies as decentralized assets. Recent discussions between US Treasury Secretary Scot Bessent and China's Vice Premier He Lifeng suggest a possible extension of the current trade truce, which temporarily eased import levies. This shift toward looser global financial conditions is encouraging investors to diversify into assets like crypto, which aren't tethered to national policies or central banks.

The US has also paused technology export restrictions on China while finalizing trade agreements with key allies such as Japan, the EU, and the UK. As capital flows more freely across borders, decentralized assets stand to benefit historically, often leading the charge in such market conditions.

Bitcoin Miner MARA Secures $950 Million to Expand BTC Holdings

Marathon Digital Holdings (MARA), the second-largest corporate holder of Bitcoin, has completed an upsized $950 million private offering to acquire additional BTC. Initially targeting $850 million, the miner capitalized on strong institutional demand through 0% convertible senior notes due in 2032.

The Florida-based firm now holds 50,000 BTC ($5.8 billion), trailing only MicroStrategy in corporate Bitcoin reserves. MARA's stock dipped 1% following the announcement, extending a 10% weekly decline despite summer gains. The company reaffirmed its long-term "HODL" strategy, mirroring industry trends of using cryptocurrency as a balance sheet asset.

U.S. Crypto Adoption Stalls Amid Deep Skepticism, Gallup Survey Reveals

Cryptocurrency ownership in the United States remains stagnant at 14% of adults, with 60% expressing no interest in digital assets, according to a Gallup survey conducted June 2-15. The data highlights a persistent distrust of crypto despite Bitcoin's price recovery and regulatory advancements like the GENIUS Act.

Demographic divides are stark: 25% of men under 50 own crypto compared to just 8% of women in the same age group. Adoption skews toward young, college-educated, higher-income conservatives—a pattern that suggests crypto remains a niche asset class rather than mainstream financial instrument.

Only 4% of Americans plan to purchase cryptocurrency in the near future, underscoring how risk perception continues to overshadow the sector's growth potential. The findings arrive as regulators attempt to bring clarity to the market through bipartisan legislation.

Bitcoin Price Could Hit $280K in the Next Major Rally: Here’s How

Bitcoin's price trajectory appears to be following a historical pattern that could propel it to between $150,000 and $280,000 by 2025. Analysts note that each bull run has occurred roughly every 1,300 to 1,500 days, preceded by a bear market and an accumulation phase. The current cycle suggests Bitcoin is nearing the end of its accumulation period, setting the stage for a significant upward move.

Historical data since 2011 reveals a consistent structure: bear markets transition into accumulation zones, followed by explosive bull runs. The most recent cycles have seen peaks at intervals of 1,500, 1,400, and 1,300 days. If this trend holds, the next rally could mirror past surges, driving Bitcoin toward the upper logarithmic trendline.

Market watchers are closely monitoring the monthly charts, which depict a clear sequence of bear markets, accumulation, and bull runs. The current phase aligns with previous cycles, hinting at a potential vertical surge in the coming months. As always, past performance is no guarantee of future results, but the pattern offers a compelling narrative for Bitcoin's next chapter.

Strategy Now Holds $71 Billion in Bitcoin—These Are Its Biggest Buys

Software firm turned Bitcoin treasury company Strategy has accumulated 607,770 BTC, worth over $71 billion at current prices. The company, led by Michael Saylor, has been aggressively buying Bitcoin for more than five years, setting a precedent for corporate crypto adoption.

Strategy's largest purchase to date came on November 25, 2024, when it acquired 55,500 BTC—a move that surpassed its previous top acquisition by more than $800 million. The firm now holds nearly 2.9% of Bitcoin's total fixed supply.

Despite pulling up its average entry price to over $71,000 per Bitcoin, Saylor remains committed to "buying the top forever." This institutional accumulation continues to reshape market dynamics as traditional finance becomes increasingly intertwined with crypto.

Trump Administration Pushes for Greater Crypto Integration in U.S. Economy

President Donald Trump's second term is cementing cryptocurrency policy as a defining legacy, with the White House preparing to deepen digital assets' role in the U.S. financial system. An upcoming executive order is expected to expand access to cryptocurrencies within 401(k) retirement plans, potentially exposing millions of Americans to the asset class despite its lack of formal regulatory framework.

The administration's comprehensive report on digital assets, mandated by Trump's January policy order, will release this week. Industry insiders anticipate detailed guidance on crypto reserves—including the proposed Bitcoin Strategic Reserve—and potential tax implications. Meanwhile, Federal Housing Finance Agency Director William Pulte has directed Fannie Mae and Freddie Mac to consider accepting cryptocurrency holdings as collateral for mortgages, a move already facing Democratic opposition.

Is This the Bitcoin Buy Zone? Where Bitcoin Bulls Might Want to Pull the Trigger

Bitcoin hovers just below its all-time high at $117,500, leaving traders debating whether to enter now or wait for a dip. Markus Thielen of 10x Research suggests patience, identifying $111,673—Bitcoin's May high turned support—as an optimal entry point for bullish traders. This level offers tighter stop-losses and better risk-reward ratios.

Retests of former resistance-turned-support often serve as launchpads for renewed upside, provided bulls defend the level. While Bitcoin remains in week four of Price Discovery Uptrend 2, a pullback could present a prime buying opportunity before the next leg up.

Traders typically seek 1:2 risk-reward setups, where a $1 risk targets $2 or more in gains. The current consolidation phase may soon resolve, offering clarity for strategic entries.

Retail Bitcoin Accumulation Outpaces Issuance as Macro Tensions Ease

Retail investors are accelerating Bitcoin accumulation at a pace exceeding new supply issuance, according to Glassnode data. Addresses holding smaller BTC balances have increased their buying velocity to levels not seen since early 2023, creating potential supply squeeze conditions.

The 90-day tariff war pause between the U.S. and China has reduced near-term macroeconomic headwinds. Market participants appear to be positioning for what analysts describe as 'the retail phase' of Bitcoin's bull cycle, following institutional accumulation throughout Q1.

Exchange reserves have dwindled to $2.385 million worth of BTC across tracked platforms. The current retail demand surge alone now absorbs 112% of daily mined supply, setting the stage for potential volatility should this trend persist through the halving epoch.

Is BTC a good investment?

Based on technical and fundamental analysis, Bitcoin (BTC) presents a compelling investment opportunity. Key factors include:

| Metric | Value | Implication |

|---|---|---|

| Price | 118,350.02 USDT | Above 20-day MA, bullish |

| MACD | 2001.6542 (bullish crossover) | Upward momentum likely |

| Bollinger Bands | Middle: 118,213.77 | Stable range, potential breakout |

Institutional adoption (e.g., Metaplanet, Strategy Now) and positive price targets ($170K-$350K) further support long-term growth. However, investors should monitor regulatory developments and macroeconomic risks.

- Technical Strength: BTC price above 20-day MA with bullish MACD crossover.

- Institutional Demand: Major players like Metaplanet and Strategy Now are accumulating BTC.

- Regulatory Risks: Delayed CFTC nomination and U.S. adoption hurdles could create volatility.